Capital Gains Tax 20245 5th

Capital Gains Tax 2025/5 5th. For the tax year 2025 to 2025 the aea will be £6,000 for individuals and personal. How easy this is to do depends on.

The tax you are liable for when selling shares and funds is called capital gains tax. How easy this is to do depends on.

Long Term Capital Gains Tax 2025 Calculator Tommy Glynnis, If you’re acting as an executor or personal representative for a deceased person’s estate, you may get the full annual exempt amount during the administration.

Capital Gains Tax For 2025 Nonie Annabell, The chancellor has confirmed that the capital gains tax (cgt) annual exempt amount will be reduced from £12,300 to £6,000 from 6 april 2025 and to £3,000 from 6 april 2025.

Tax Tables 2025 Irs For Capital Gains Vanda Miranda, For the 2025 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Capital Gains Tax 2025 Gov Uk Wendy Joycelin, It’s the gain you make that’s taxed, not the amount of money.

Irs Capital Gains Tax Rates 2025 Timi Adelind, Here’s a summary of the main tax changes you need to know.

Capital Gain Tax Calculator For Ay 2025 25 Image to u, Our capital gains tax calculator gives you an estimate of how much you could have to pay in capital gains tax (cgt) when you sell your property in the uk.

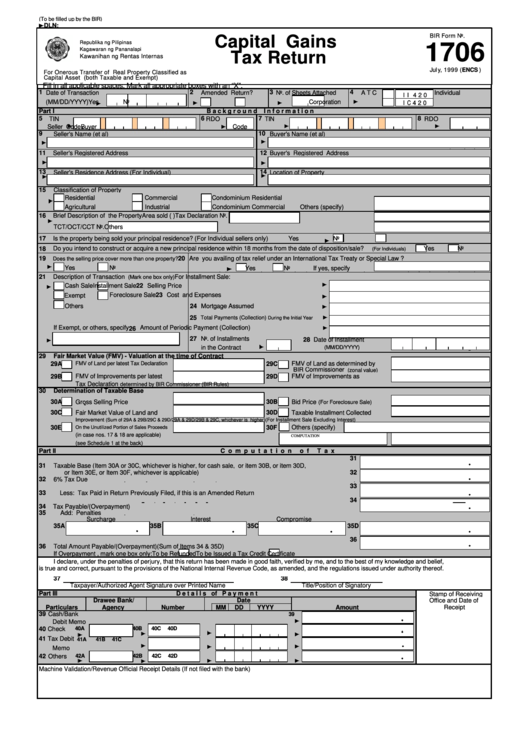

Capital Gains Tax Worksheet 2025, You’ll then need to file and pay your capital gains tax bill by 31st january each tax year.

Capital Gains Tax Brackets And Tax Tables For 2025, The rate of cgt that you pay each year depends on the type of asset you’ve sold and how much.

Capital Gains Tax Table 2025 Moyra Tiffany, The new 2025/25 tax year brings with it several significant changes that could have an impact on your finances.

Long Term Capital Gains Tax Brackets 2025 Gnni Malissa, For the 2025 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Travel Hiking WordPress Theme By WP Elemento