Oregon Sui Wage Base 2025

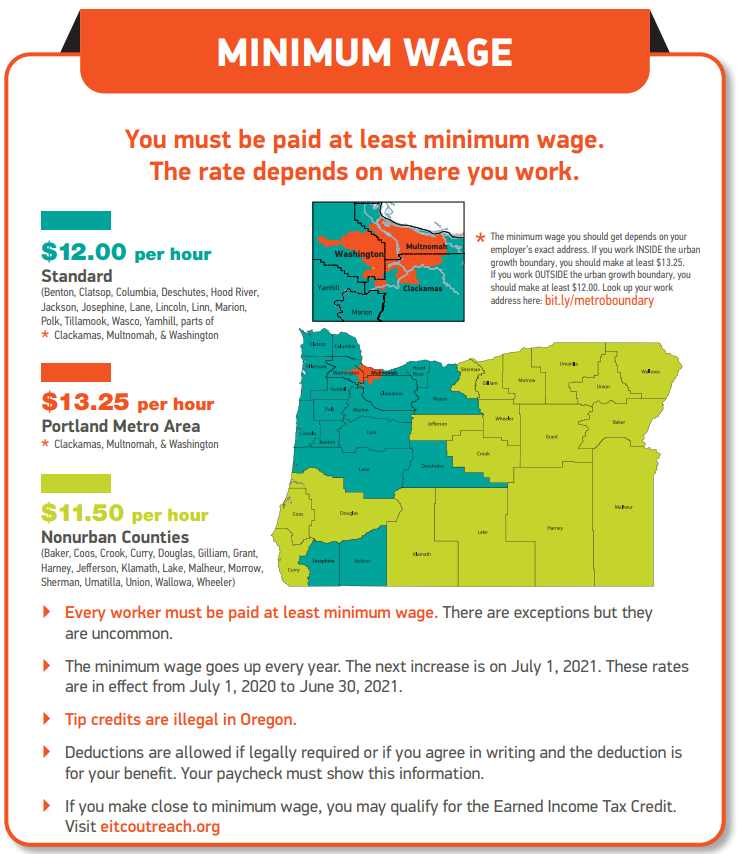

Oregon Sui Wage Base 2025. Within the urban growth boundary, including parts of clackamas, multnomah, and. For july 1, 2025 through june 30, 2025, those rates are:

“the unemployment insurance payroll tax for new employers will rise slightly in 2025 from the current rate of 2.1% on taxable wages up to $50,900 per employee,” said david. After 2026, the taxable wage base will be adjusted by changes in the annual average weekly wage.

Unemployment tax rates for employers subject to oregon payroll tax will move to tax schedule three for the 2025 calendar year.

Oregon Sui Wage Base 2025 Lisa Sheree, Effective january 1, 2025, legislation (sb 1828/chapter 412) increased the sui taxable wage base to $8,000, up from $7,000. Unemployment tax rates for employers subject to oregon payroll tax will move to tax schedule three for the 2025 calendar year.

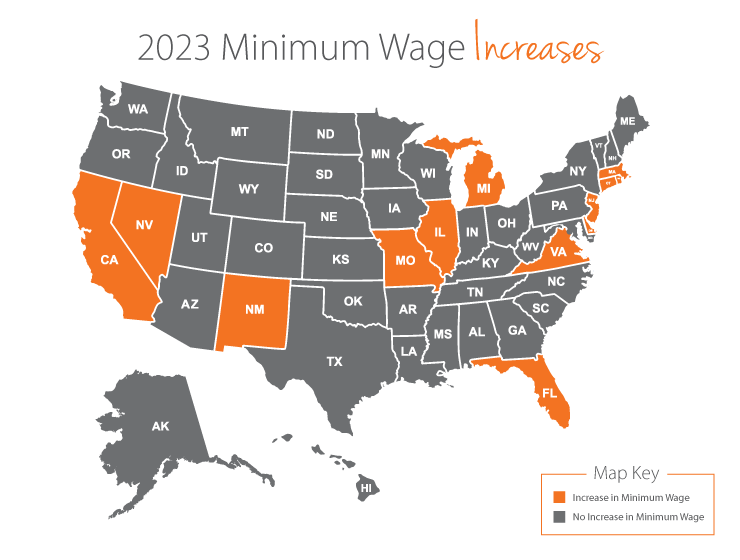

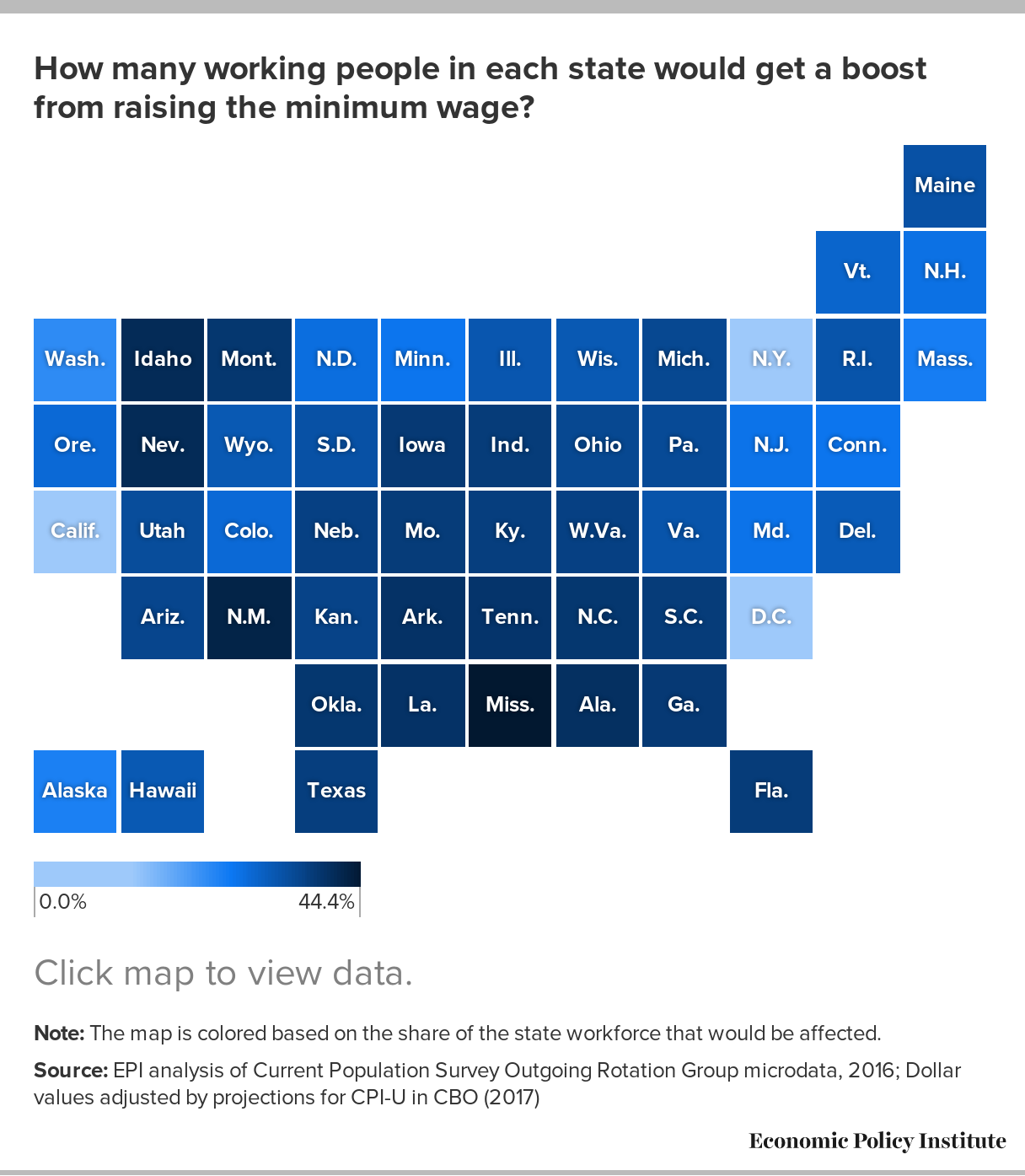

Map of U.S. States with 2025 Minimum Wage Increases, Several states have released their state unemployment. Register as an employer on the oregon employment development website.

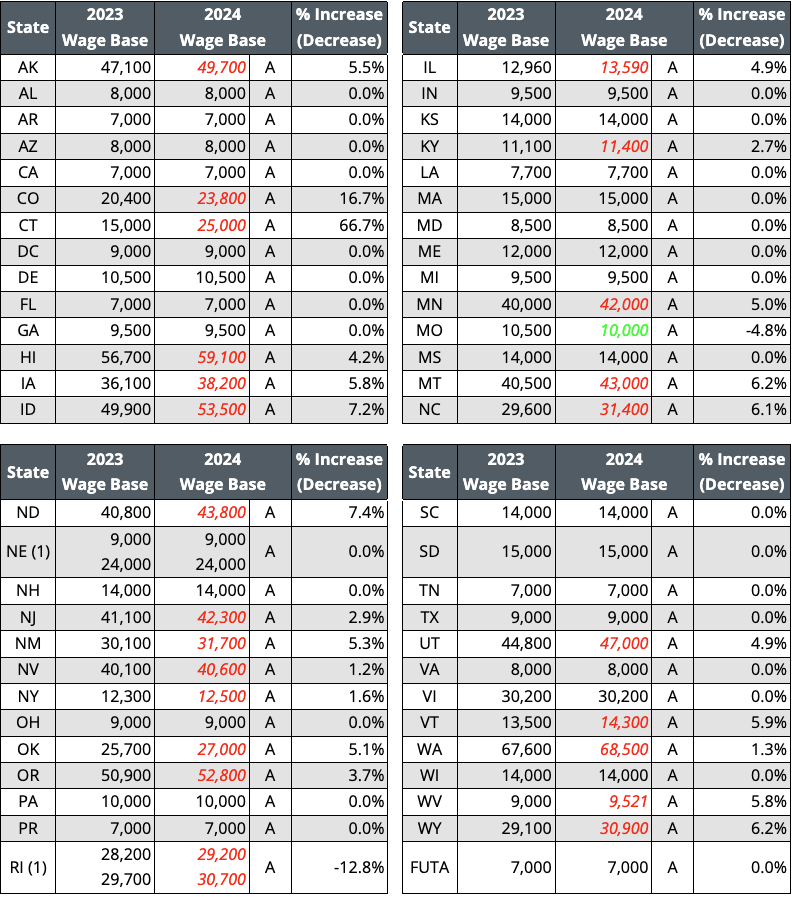

2025 to 2025 State Extended Unemployment Benefits Maximum Weeks of, An updated chart of state taxable wage bases. The new employer rate increased to 2.6% for 2025, up from 2.1% for 2025.

Oregon House approves 3tiered minimum wage increase KVAL, 2025 payroll tax reporting instructions for oregon employers. The 2025 sui taxable wage base increased to $43,800, up from $42,100 for 2025.

Oregon’s minimum wage is going up July 1 Here’s what it will be in, State unemployment insurance taxable wage bases for 2025. The fli wage base will rise $35,700 from 2025 to 2025.

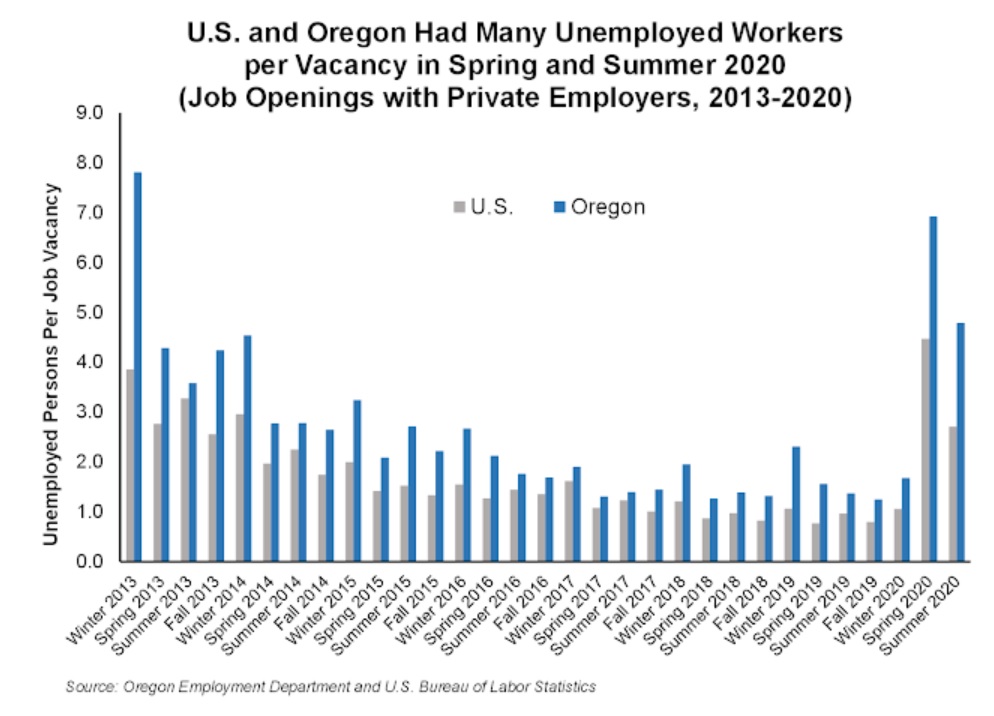

Outlook for State Unemployment Insurance (SUI) Tax Rates in 2025 and Beyond, Oregon announcement relating to 2025 unemployment tax rates and wage base the oregon 2025 sui tax rates were issued on november 15, 2025. 2025 payroll tax reporting instructions for oregon employers.

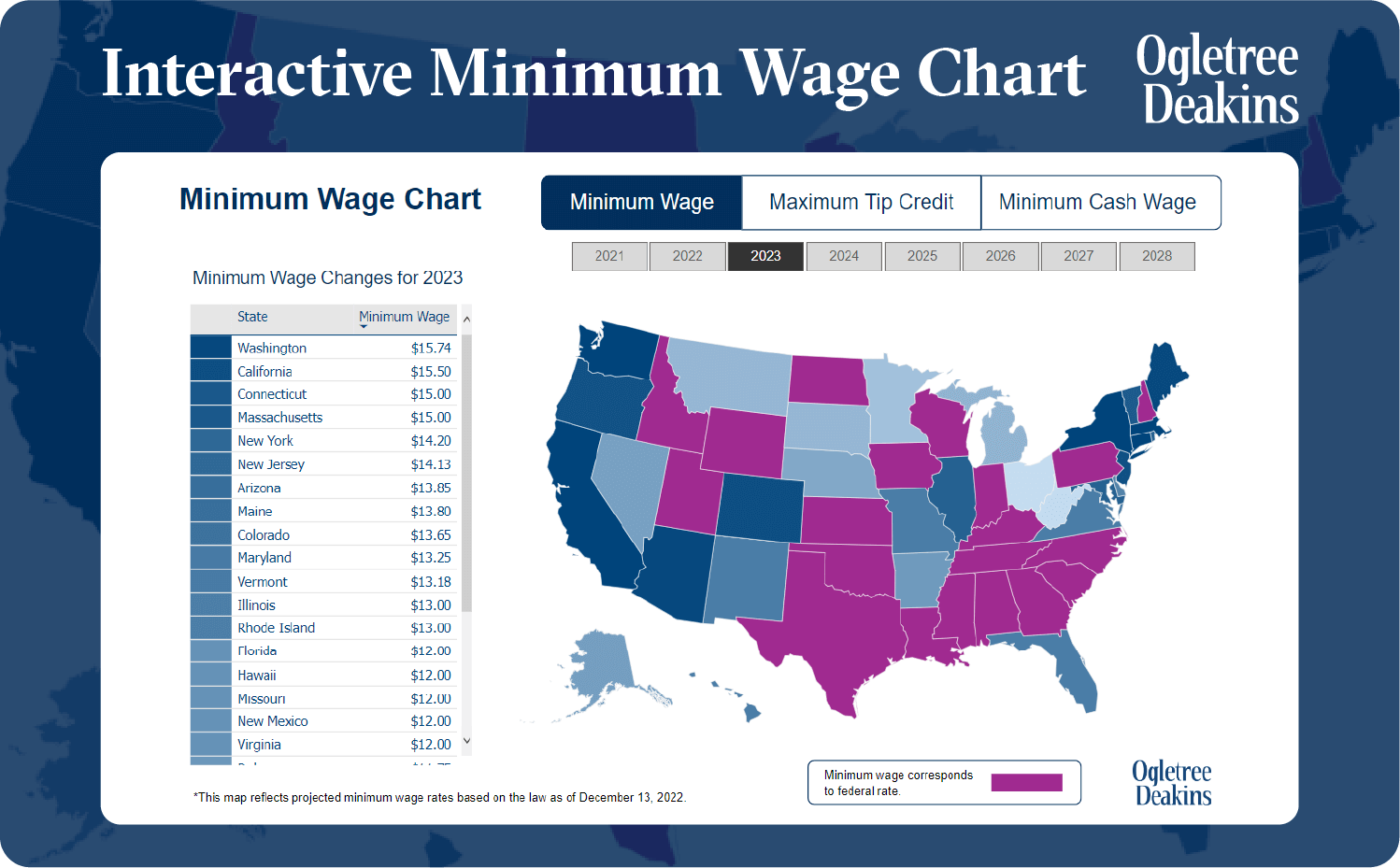

State and Major Locality Minimum Wage Updates for 2025 Ogletree Deakins, State unemployment insurance taxable wage base chart updated for 2025. “the unemployment insurance payroll tax for new employers will rise slightly in 2025 from the current rate of 2.1% on taxable wages up to $50,900 per employee,” said david.

Oregon minimum wage will rise again on July 1 nwLaborPress, Oregon’s unemployment tax rates will be determined using schedule 3. Oregon announcement relating to 2025 unemployment tax rates and wage base the oregon 2025 sui tax rates were issued on november 15, 2025.

Average Oregon wage for new jobs is 19.18, Effective january 1, 2025, legislation (sb 1828/chapter 412) increased the sui taxable wage base to $8,000, up from $7,000. After 2026, the taxable wage base will be adjusted by changes in the annual average weekly wage.

How raising the minimum wage to 15 by 2025 will benefit women, Individual taxable earnings of up to $168,600. After 2026, the taxable wage base will be adjusted by changes in.